When you pick up a prescription at your local pharmacy and see a generic version of your usual brand-name drug, you might think it’s just a cheaper copy. But behind that small pill or capsule is a complex, highly regulated journey that starts with a single document filed with the FDA - the Abbreviated New Drug Application, or ANDA. This isn’t a shortcut. It’s a precision-engineered path that ensures generics are just as safe and effective as the originals - and it’s the reason you’re paying 80% less.

The ANDA: What It Really Is

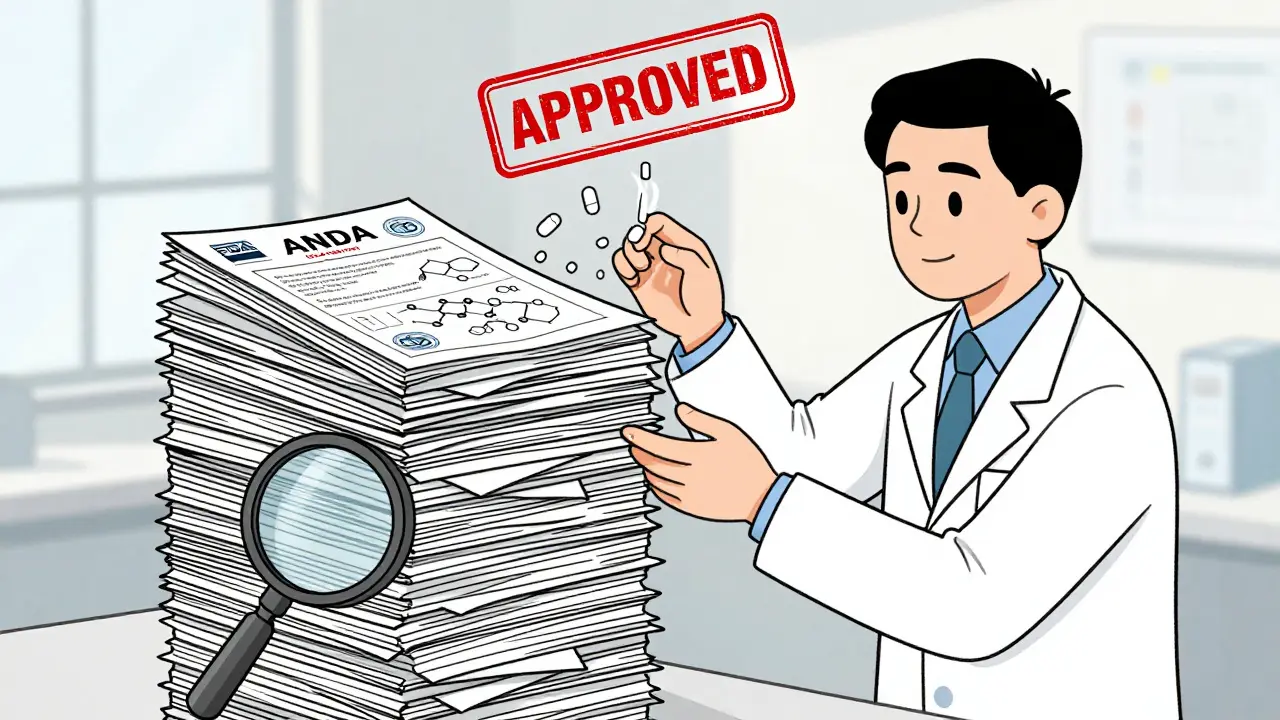

The ANDA isn’t just paperwork. It’s a legal and scientific promise to the FDA that a generic drug is therapeutically identical to the brand-name version. Under the Hatch-Waxman Act of 1984, manufacturers don’t need to redo costly clinical trials. Instead, they prove bioequivalence - meaning the generic delivers the same amount of active ingredient into your bloodstream at the same rate as the brand drug. That’s it. No new animal studies. No Phase III human trials. Just solid chemistry, manufacturing data, and proof that your body absorbs it the same way.

But don’t be fooled by the word ‘abbreviated.’ A complete ANDA is a 10,000-page monster. It includes every detail: how the active ingredient is made, what excipients are used, how the tablet is compressed, even the exact specifications of the packaging material. The FDA checks every line. And if one thing’s off - say, the dissolution rate of the pill is off by 5% - the application gets rejected. In fact, nearly 40% of initial ANDA submissions get a Complete Response Letter from the FDA, meaning they need to fix something before approval.

From Submission to Approval: The Waiting Game

Once the ANDA is submitted electronically through the FDA’s Electronic Submissions Gateway, the clock starts. Under current GDUFA rules, the standard review time is about 30 months. But that’s not the whole story. Some applications get priority. First generics - the very first version of a drug to hit the market after patent expiry - are fast-tracked. So are drugs that treat shortages, like insulin or antibiotics. In 2022, the FDA approved 112 first generics alone, covering drugs worth $39 billion in annual sales.

Here’s where things get competitive. If a company files an ANDA with a Paragraph IV certification - basically saying, ‘We think your patent is invalid or won’t be enforced’ - it triggers a 30-month legal stay. That’s why you sometimes see six different companies filing ANDAs for the same drug on the same day. The first one to file gets 180 days of exclusive marketing rights. That’s worth millions. In 2022, six manufacturers raced to file for apixaban (Eliquis), the blood thinner, knowing that whoever won first-to-file could dominate the market before others even got approved.

Approval Doesn’t Mean Availability

Just because the FDA says ‘yes’ doesn’t mean your pharmacy will have the drug next week. In fact, most manufacturers say approval is only the halfway point. After approval, the real work begins: scaling up production.

Going from lab batches to commercial-scale production takes 60 to 120 days. You can’t just crank out millions of pills overnight. The equipment has to be cleaned, validated, and certified. Every batch must meet strict quality standards. One batch fails a sterility test? The whole line shuts down. That’s why some generic manufacturers have entire teams dedicated to process validation - not just to meet FDA rules, but to avoid costly recalls.

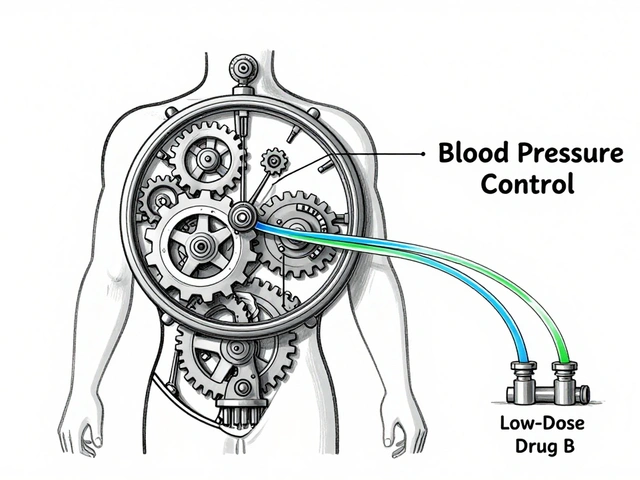

Then comes the payer maze. Pharmacy Benefit Managers (PBMs) like Express Scripts, OptumRx, and CVS Health control which drugs get covered and at what price. Getting on their preferred tier - Tier 1 - is critical. A 2023 IQVIA analysis showed that generics on Tier 1 capture 75% of prescriptions within six months. Tier 2? Only 35%. To get there, manufacturers often have to offer discounts of 20-30% beyond their initial price. One sourcing manager on Reddit put it bluntly: ‘If you don’t give PBMs a deep enough discount, your drug might as well not exist.’

The Distribution Pipeline

Once the drug is made and the PBM deal is signed, it hits the distribution network. Three giants control 90% of this: AmerisourceBergen, McKesson, and Cardinal Health. These wholesalers don’t just store pills - they manage inventory for thousands of pharmacies. Adding a new generic to their system takes 15 to 30 days. The drug gets a new National Drug Code (NDC), loaded into their software, and routed to regional distribution centers.

But here’s the catch: not all wholesalers carry every generic. Some only stock high-volume drugs. Others require minimum order quantities. That’s why smaller generic manufacturers sometimes partner with specialty distributors or even sell directly to large pharmacy chains like CVS or Walgreens to bypass the middlemen.

The Final Step: Pharmacy Shelves

The last leg of the journey is the pharmacy itself. Even when the drug arrives at the store, it’s not ready to sell. The pharmacy’s computer system has to be updated. The new NDC must be entered. Pharmacists and technicians need to be trained on the new product - especially if it’s a complex form like an inhaler or transdermal patch. That usually takes 7 to 14 days.

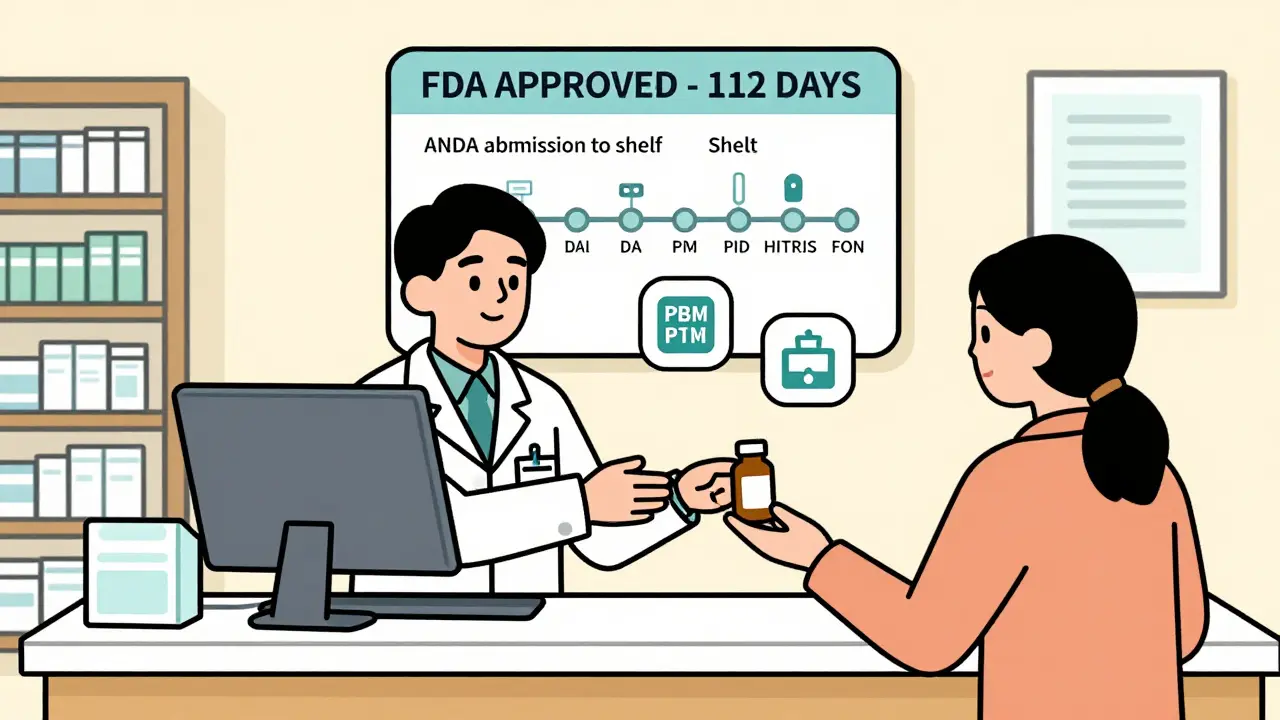

On average, it takes 112 days from FDA approval to the first prescription being filled. But it varies. Cardiovascular generics - like metoprolol or lisinopril - move fast. They’re high-volume, low-complexity drugs. Approval to shelf? As little as 87 days. But complex generics - think inhalers, topical creams, or injectables - can take 145 days or more. Why? Because each one requires extra testing, special handling, and more negotiation with PBMs who are wary of switching patients to unfamiliar formulations.

Why This System Works - And Why It’s Under Pressure

The ANDA system has saved U.S. consumers over $1.67 trillion in the last decade. In 2022, generics made up 90% of all prescriptions filled. That’s 6.3 billion prescriptions. And yet, the system is under strain. Generic drug prices have dropped 4.7% every year since 2015. Manufacturers are squeezing margins thinner and thinner. Some have left the market entirely, especially for low-margin, high-volume drugs like antibiotics or painkillers.

The FDA is responding. Their Drug Competition Action Plan aims to prevent patent abuse and speed up approvals. GDUFA III, running from 2023 to 2027, pushes for real-time application tracking and better communication between companies and regulators. And they’re paying more attention to complex generics - products that were once ignored because they were ‘too hard’ to copy. Now, with more than 600 complex generics approved since 2018, the agency is building specialized review teams to handle them.

Artificial intelligence might change things next. Early experiments show AI can predict bioequivalence outcomes or flag CMC issues before submission, cutting prep time by up to 30%. But regulators are cautious. The FDA doesn’t yet accept AI-generated data as standalone proof. That’s changing slowly - but for now, human reviewers still read every page.

What This Means for You

When you pick up a generic, you’re not just saving money. You’re benefiting from a system designed to balance innovation with access. That system relies on thousands of scientists, regulators, and logistics workers who make sure that pill you’re taking is safe, effective, and affordable. It’s not perfect. Delays happen. Some drugs still don’t get generic versions for years. But the framework - from ANDA to shelf - is one of the most successful public health tools ever built.

And if you ever wonder why your generic costs $4 instead of $40 - now you know. It’s not luck. It’s science, regulation, and a whole lot of paperwork.

What is an ANDA and why does it matter for generic drugs?

An ANDA, or Abbreviated New Drug Application, is the formal request a generic drug manufacturer submits to the FDA to get approval to sell a generic version of a brand-name drug. It matters because it allows companies to prove their product is bioequivalent to the original without repeating expensive clinical trials. This keeps generic drug prices low while ensuring they work the same way in your body.

How long does it take for a generic drug to reach the pharmacy after FDA approval?

On average, it takes about 112 days from FDA approval to the first prescription being filled at a retail pharmacy. This includes scaling up production, negotiating with pharmacy benefit managers (PBMs), getting the drug into the distribution system, and updating pharmacy software. For simpler drugs like blood pressure pills, it can be as fast as 87 days. For complex drugs like inhalers or creams, it can take over 145 days.

Why do some generic drugs take longer to appear on shelves than others?

Complex generics - like transdermal patches, inhalers, or injectables - are harder to manufacture and replicate exactly. They require more testing, stricter quality controls, and more negotiation with PBMs who are cautious about switching patients. Simple pills, like metoprolol or amoxicillin, are easier to copy and have high demand, so they move faster through the system.

Do pharmacy benefit managers (PBMs) really control whether a generic drug gets sold?

Yes. PBMs like Express Scripts and OptumRx decide which drugs are covered and on which tier - Tier 1 (preferred), Tier 2, or Tier 3. If a generic isn’t on Tier 1, pharmacies may not stock it, or patients may pay much more. Manufacturers often have to offer deep discounts - 20-30% below list price - just to get on the preferred list. Without PBM approval, even an FDA-approved generic may never reach your pharmacy.

Why do some generic drugs cost more than others even if they’re the same medicine?

Price differences come down to competition, manufacturing costs, and PBM contracts. If only one company makes a generic, they can charge more. If five companies make it, prices drop. Also, generics made overseas may cost less to produce but face higher shipping and regulatory hurdles. And if a drug is on a PBM’s preferred list, the pharmacy gets a better rebate - which can lower the price you pay at the counter.

Are generic drugs as safe and effective as brand-name drugs?

Yes. The FDA requires generics to have the same active ingredient, strength, dosage form, and route of administration as the brand-name drug. They must also prove bioequivalence - meaning they deliver the same amount of medicine into your bloodstream at the same rate. Studies show generics perform just as well in real-world use. The only differences are in inactive ingredients, which rarely affect how the drug works.

January 28, 2026 AT 22:09

Really appreciate this breakdown. I never realized how much goes into getting a generic on the shelf. It’s not just ‘copying a pill’-it’s a whole science project with regulatory hurdles, manufacturing precision, and payer politics. Makes me feel better about taking generics instead of stressing over brand names.